How Top Tech Recruiting Companies Are Transforming Talent Acquisition

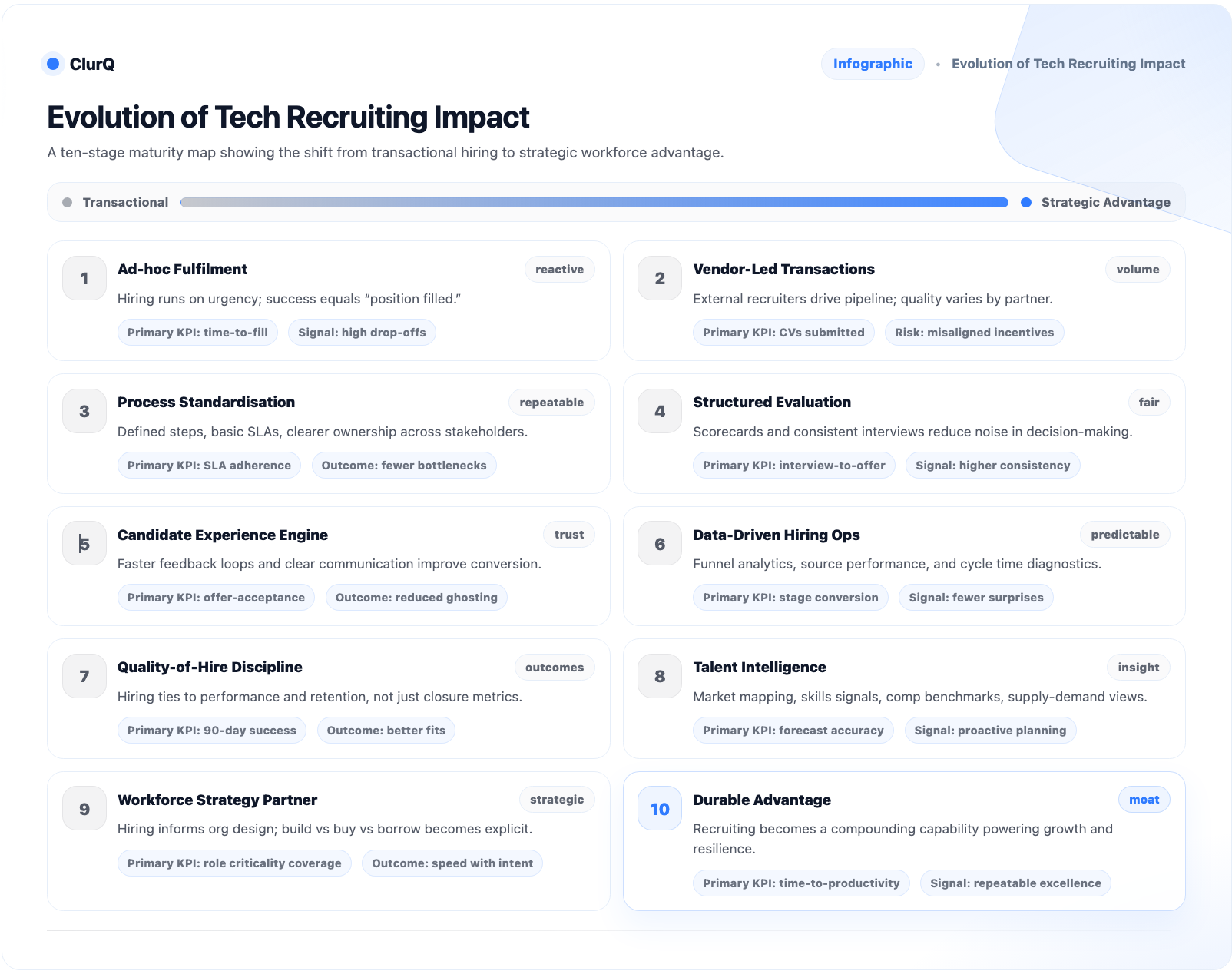

Technology hiring across global and Indian markets has entered a structural reset phase. Talent demand no longer rises purely from headcount expansion but from capability depth, delivery readiness, and speed alignment. Traditional recruitment models, designed around volume fulfilment, struggle within this environment. Leading tech recruiting companies now operate less like vendors and more like embedded hiring partners, reshaping how talent acquisition functions across organisations.

Several forces drive this shift. First, product cycles shorten while skill half-life compresses. Second, distributed work models expand talent pools while simultaneously increasing assessment complexity. Third, leadership teams demand measurable hiring outcomes rather than process efficiency metrics. Together, these forces push recruiting firms toward capability-led, outcome-oriented operating models.

Top-performing recruiting organisations respond through redesigned workflows. Resume screening gives way toward skill validation. Linear pipelines evolve toward parallel evaluation stages. Hiring conversations begin earlier, supported through structured problem statements rather than static role descriptions. This transformation reflects strategy alignment rather than tooling upgrades alone.

Within this context, platforms enabling structured hiring workflows gain relevance.

From Volume Hiring Toward Capability-Centric Sourcing

Building upon this structural reset, leading tech recruiting companies redesign sourcing logic itself. Earlier models optimised candidate inflow volume, assuming downstream interviews would filter quality. That assumption fails under current constraints, where interview bandwidth remains limited and hiring errors carry amplified cost. Modern recruiting leaders therefore invert sourcing priorities, starting with capability definition rather than candidate accumulation.

Capability-centric sourcing begins through precise articulation around problem scope, delivery environment, and decision ownership. Recruiters collaborate closely with business leaders, clarifying expectations around outcomes within ninety, one hundred eighty, and three hundred sixty day horizons. This clarity enables sharper market scanning and reduces mismatch risk early within pipeline creation.

Advanced recruiting firms deploy curated talent pools instead of broad outreach. They maintain continuously refreshed networks mapped against functional depth, industry exposure, and execution maturity. Candidate engagement becomes contextual, referencing real challenges rather than generic opportunities. This approach significantly improves response relevance and candidate intent alignment.

Technology platforms supporting structured requirement capture play a critical role here. As sourcing precision improves, downstream evaluation complexity increases. Recruiting companies must therefore evolve assessment mechanisms beyond traditional interviews, which naturally leads into how evaluation frameworks now redefine hiring confidence in the following section.

Redesigning Evaluation Through Evidence-Based Assessment

Following sharper sourcing precision, evaluation practices undergo fundamental redesign. Leading tech recruiting companies recognise interviews alone cannot reliably predict delivery success. Conversational assessment favours articulation skill, familiarity bias, and preparation advantage, while real performance often emerges under execution conditions. Modern hiring leaders therefore prioritise evidence generation across assessment stages.

Evidence-based evaluation introduces structured task frameworks aligned with actual role demands. Candidates engage with short problem statements, simulated deliverables, or scenario walkthroughs reflecting daily work realities. Output quality, decision logic, and execution clarity receive greater weight than verbal confidence. This shift improves signal strength while reducing interviewer subjectivity.

High-performing recruiting firms orchestrate parallel evaluation tracks. Skill validation, communication assessment, and intent confirmation progress simultaneously rather than sequentially. This reduces cycle time while preserving depth. Importantly, candidate experience improves through transparency, since expectations remain clearly defined across each stage.

Digital infrastructure plays an enabling role within this model. As evaluation becomes more rigorous, decision-making responsibility expands beyond recruiters alone. Hiring outcomes increasingly depend upon stakeholder alignment and data-backed confidence, creating the foundation for evolved hiring governance models addressed next, without breaking narrative continuity.

Strengthening Hiring Governance Through Shared Accountability

As assessment frameworks mature, leading tech recruiting companies strengthen governance structures around hiring decisions. Earlier models positioned recruiters as gatekeepers and hiring managers as final approvers. That separation creates accountability gaps, especially when hiring outcomes underperform. Modern talent acquisition leaders instead design shared ownership models anchored around data visibility and decision traceability.

Shared accountability begins with clearly defined decision roles. Recruiters own pipeline integrity and signal quality. Hiring managers own role clarity and evaluation alignment. Business leaders own outcome expectation and ramp success. Each stakeholder engages earlier within the process, reducing late-stage friction and post-hire regret.

Data-backed governance reinforces this structure. Evaluation scores, task outputs, and intent indicators remain visible across stakeholders rather than locked within recruiter notes. This transparency enables faster alignment while discouraging instinct-led overrides unsupported by evidence. Recruiting partners evolve from intermediaries toward advisors guiding structured decisions.

Technology platforms supporting role-based visibility become essential within this operating model. Once governance clarity strengthens, recruiting companies face a new challenge: managing scale without quality erosion. Addressing that tension requires process standardisation without rigidity, which naturally flows into the next section without interrupting narrative continuity.

Scaling Hiring Operations Without Quality Dilution

With governance discipline established, top tech recruiting companies confront scale pressure. Growth plans demand faster hiring velocity, yet capability standards cannot weaken. High-performing firms resolve this tension through modular process design rather than rigid standardisation. Each hiring stage remains consistent, while role-specific depth flexes based upon complexity and risk exposure.

Modular hiring architecture separates universal elements from contextual ones. Core stages such as requirement clarity, capability validation, and intent confirmation remain fixed. Role-sensitive layers such as technical depth, domain exposure, or stakeholder interaction expand selectively. This approach preserves comparability across hires while respecting functional nuance.

Recruiting partners play a crucial orchestration role here. They monitor signal quality across modules, intervene when drop-offs emerge, and recalibrate assessment weightage based upon hiring outcomes. Continuous feedback loops replace static playbooks, enabling improvement without disruption.

Operational visibility supports this model. At scale, another variable becomes decisive: candidate trust. As hiring systems grow sophisticated, maintaining human credibility and communication clarity becomes essential, setting up the next section seamlessly without narrative break.

Building Candidate Trust Through Transparent Hiring Systems

At advanced scale, candidate trust emerges as a decisive differentiator among top tech recruiting companies. Sophisticated pipelines without communication clarity often generate confusion, disengagement, and brand erosion. Market leaders recognise that transparency across hiring stages directly influences candidate commitment, offer acceptance, and long-term employer perception.

Transparent hiring systems clarify expectations early. Candidates understand evaluation logic, assessment purpose, and decision timelines before participation begins. Feedback loops remain structured, consistent, and timely, reducing uncertainty anxiety across extended hiring cycles. This clarity positions recruiting partners as credible advisors rather than transactional intermediaries.

Communication quality also improves intent validation. Candidates engaging through transparent systems self-select more effectively, reducing late-stage dropouts. Recruiters spend less effort managing follow-ups and more effort strengthening hiring signal quality. Over time, this trust compound effect improves both efficiency and outcomes.

Platforms supporting candidate visibility enable this transformation. Once trust strengthens across candidate touchpoints, recruiting companies unlock deeper strategic value. They transition beyond execution partners toward workforce intelligence providers, naturally leading into the next section without narrative interruption.

Evolving Recruiting Partners Into Workforce Intelligence Advisors

With candidate trust embedded across hiring systems, leading tech recruiting companies extend value beyond transactional fulfilment. They reposition capability from execution support toward workforce intelligence advisory. This evolution reflects growing leadership demand for foresight around talent availability, skill pricing, and delivery risk rather than reactive hiring activity.

Workforce intelligence emerges through continuous market sensing. Recruiting partners analyse demand patterns, skill saturation levels, compensation movement, and ramp success trends across roles and industries. Insights inform workforce planning conversations earlier within budgeting and roadmap cycles. Hiring discussions shift upstream, supporting leadership decisions before requisitions materialise.

This advisory posture also strengthens risk management. Predictive signals highlight roles with extended closure risk, skill scarcity pressure, or onboarding fragility. Organisations adjust timelines, prioritisation, or capability mix accordingly. Recruiting partners thereby reduce downstream disruption while improving hiring confidence.

Data consolidation platforms enable this transformation. As recruiting companies assume advisory influence, pricing models and partnership structures evolve as well. Value aligns with outcomes delivered rather than resumes shared, which transitions naturally into the next section without narrative break.

Shifting Pricing Models From Activity Metrics Toward Hiring Outcomes

As recruiting partners evolve toward advisory relevance, commercial structures adjust accordingly. Leading tech recruiting companies move away from activity-linked pricing, such as resume submissions or interview coordination, toward outcome-aligned engagement models. This shift reflects maturity across both buyer expectations and recruiting capability.

Outcome-oriented pricing anchors around measurable hiring impact. Metrics include role closure confidence, candidate quality index, joining ratio stability, and post-joining performance signals. Commercial alignment improves trust, since recruiting partners share accountability across success rather than volume throughput. Clients gain clarity around value delivered, while recruiters focus energy upon signal quality rather than pipeline inflation.

Hybrid engagement structures also emerge. Fixed platform access combines with variable success-linked components, balancing predictability with performance incentive. Longer-term partnerships replace transactional mandates, enabling recruiters access toward planning cycles, workforce forecasts, and capability roadmaps earlier within decision journeys.

Technology platforms supporting outcome measurement enable this model transition. Once pricing aligns with outcomes, attention naturally shifts toward internal enablement. Recruiting transformation sustains only when client teams adopt new behaviours and decision frameworks, which flows seamlessly into the next section.

Enabling Internal Teams Through Process Adoption And Decision Discipline

Outcome-aligned recruiting models deliver sustained value only when internal teams adapt operating behaviour accordingly. Top tech recruiting companies therefore invest significantly within client enablement, ensuring hiring managers, interviewers, and leadership teams adopt structured decision discipline rather than reverting toward intuition-driven shortcuts.

Enablement begins with role clarity ownership. Hiring managers learn framing problems, success criteria, and non-negotiable capabilities upfront. Interviewers receive guidance around evaluation focus, evidence interpretation, and bias control. Leadership teams engage through calibrated checkpoints rather than late-stage overrides. This shared understanding reduces friction and improves cycle predictability.

Process adoption also depends upon simplicity. Leading recruiting partners avoid complexity creep, ensuring workflows remain intuitive despite depth. Standard templates, clear signals, and visible progress indicators help internal teams engage confidently without operational fatigue. Over time, hiring maturity compounds across organisations rather than resetting per role.

Platforms supporting adoption discipline play a central role here.As internal capability strengthens, organisations achieve consistent hiring performance rather than episodic success. This maturity sets the stage for examining long-term competitive advantage created through transformed talent acquisition models, concluding the narrative in the final section without disruption.

Creating Durable Competitive Advantage Through Transformed Talent Acquisition

When hiring maturity reaches this stage, talent acquisition shifts from operational necessity toward strategic advantage. Top tech recruiting companies enable organisations build repeatable hiring confidence, reducing dependency upon hero recruiters or favourable market cycles. Capability access becomes predictable, scalable, and aligned with business execution timelines.

This advantage compounds across multiple dimensions. Faster role closure improves product velocity. Higher joining ratios stabilise delivery planning. Stronger post-joining performance reduces downstream attrition and re-hiring cost. Over time, organisations attract stronger inbound talent through market reputation built upon fairness, clarity, and execution credibility.

Recruiting partners remain central within this ecosystem. Their value no longer rests upon speed alone but upon judgement, intelligence, and governance enablement. They function as long-term capability partners embedded within growth strategy rather than short-term fulfilment agents.

Platforms anchoring this transformation provide continuity across people, process, and insight layers.